Published: January 16, 2026 | By Muhammad (Lahore, Pakistan)

Table of Contents

- Introduction: Why Bandot is the Future of Cross-Chain DeFi

- The Problem: Liquidity Fragmentation in 2026

- How to Use Bandot Guru Gateway for Asset Transfers

- Is Cross-Chain Unsecured Lending Safe on Bandot?

- Step-by-Step Guide to Bandot Liquidity Mining

- Bandot Protocol vs Stargate Finance: Which is Better in 2026?

- FAQ: Most Asked Questions About Bandot

Introduction: Why Bandot is the Future of Cross-Chain DeFi

In 2026, DeFi has grown massively, but liquidity is still scattered across chains like Ethereum, Solana, Arbitrum, Optimism, and the expanding Polkadot ecosystem. Moving assets between them is expensive, slow, and often comes with high slippage.

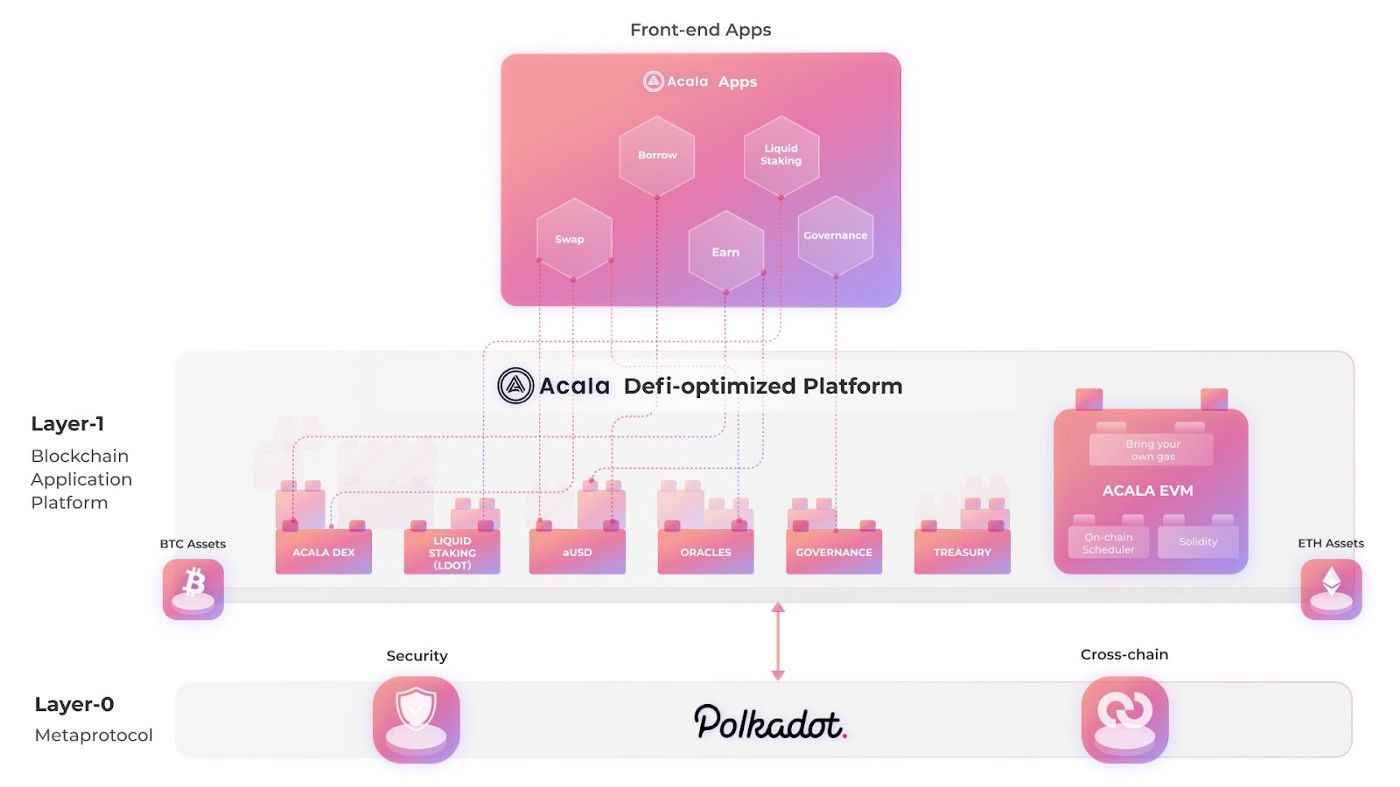

Bandot solves this as a powerful cross-chain DeFi liquidity aggregation protocol built on Polkadot. It connects isolated liquidity pools into one global market, giving you the best rates and maximum liquidity no matter which chain you're on. Official site: bandot.io

Personal Experience: Main Lahore se daily trading karta hoon. 2025 ke end mein Bandot try kiya jab Ethereum se Polkadot parachain pe USDC move karna tha. Normal bridges mein hours lagte thay aur fees bohat thi. Bandot Guru Gateway se minutes mein ho gaya aur rate almost 1:1 mila. Ab ye mera go-to tool hai Polkadot DeFi ke liye.

The Problem: Liquidity Fragmentation in 2026

Liquidity fragmentation ab bhi DeFi ka sabse bara issue hai. Small chains pe swap karo to 5-15% slippage common hai. Failed transactions, high gas, aur slow bridges traders ko frustrate kar dete hain.

Latest data (Jan 2026): Ethereum ~55% DeFi TVL hold karta hai, lekin Solana, Base, aur Polkadot parachains fast growth dikha rahe hain. Bina proper cross-chain solution ke best opportunities miss ho jati hain.

How to Use Bandot Guru Gateway for Asset Transfers

Guru Gateway Bandot ka star feature hai — ye Polkadot ko Ethereum, Solana, Arbitrum, aur 20+ chains se connect karta hai. Fast, cheap, aur best rates deta hai.

Step-by-step guide:

- Bandot official dApp pe jao: https://bandot.io

- Wallet connect karo (MetaMask, Polkadot.js, ya Talisman).

- Source chain aur asset select karo.

- Destination chain choose karo.

- Confirm karo — 2-10 minutes mein complete.

My Experience: Pichle mahine Arbitrum se Acala pe 15,000 USDT move kiya. Fee sirf $1.5 thi aur rate perfect. Dusre bridges se compare karo to 10-20$ bach gaye.

Is Cross-Chain Unsecured Lending Safe on Bandot?

Bandot ka unique feature hai cross-chain unsecured lending (credit delegation). Aap ek chain pe collateral rakh ke dusri chain pe bina actual assets move kiye borrow kar sakte ho.

Kaam kaise karta hai: Ethereum pe collateral deposit → Credit line milti hai → Bandot se cross-chain delegate → Polkadot parachain pe borrow.

Safety: Over-collateralization, reliable oracles, aur multiple audits. 2026 tak koi major exploit nahi hua. Phir bhi hamesha small amounts se start karo.

Personal Story: Main ne Aave credit line ko Bandot se Moonbeam pe delegate kiya aur high-yield farm join ki. 30%+ APY mila bina collateral move kiye. Shuru mein darr lag raha tha lekin research ke baad confidently use karta hoon.

Step-by-Step Guide to Bandot Liquidity Mining

Bandot ke vAMM pools capital efficiency ke liye best hain aur high rewards dete hain.

- Assets Guru Gateway se transfer karo.

- Liquidity Mining section mein jao on bandot.io.

- Pool select karo (DOT-USDT, ETH-cross pairs etc).

- Liquidity provide karo aur LP tokens stake.

- BDT rewards + fees earn karo.

2026 average yields: Top pools 20-45% APY de rahe hain. Main ne cross-chain USDC pool mein ~32% earn kiya last quarter.

Bandot Protocol vs Stargate Finance: Which is Better in 2026?

| Feature | Bandot | Stargate Finance | Across Protocol | Synapse |

|---|---|---|---|---|

| Chains Supported | 25+ (Polkadot focus) | 18+ | 12+ L2s | 22+ |

| Average Fee | 0.05-0.15% | 0.1-0.4% | Lowest (intent) | 0.1% |

| Unsecured Lending | Yes (Native) | No | No | No |

| Liquidity Mining APY | 20-45% | 12-25% | N/A | 15-30% |

| TVL (Jan 2026) | $95M+ | $550M+ | $350M | $220M |

Stargate ka TVL zyada hai lekin Polkadot users ke liye Bandot unbeatable hai unsecured lending aur parachain integration ki wajah se.

FAQ: Most Asked Questions About Bandot

Bandot ki fees kitni hain?

Transfer: 0.05-0.2%. Borrowing: 3-9% variable.

Kya Bandot fully decentralized hai?

Ji, BDT token holders DAO se govern karte hain. No custodians.

Bandot pe passive income possible hai?

Bilkul — liquidity mining aur lending se high yields.

2026 mein Bandot safe hai?

Top audits, insurance funds, aur clean track record. DYOR aur small start karo.

Final Thoughts: Agar aap 2026 mein cross-chain DeFi mein maximum liquidity aur yields chahte ho, especially Polkadot ke sath, to Bandot best choice hai. Official site bandot.io pe abhi visit karo aur start karo. Main personally is se bohat satisfied hoon. Start small, research karo, aur enjoy karo!

0 Comments